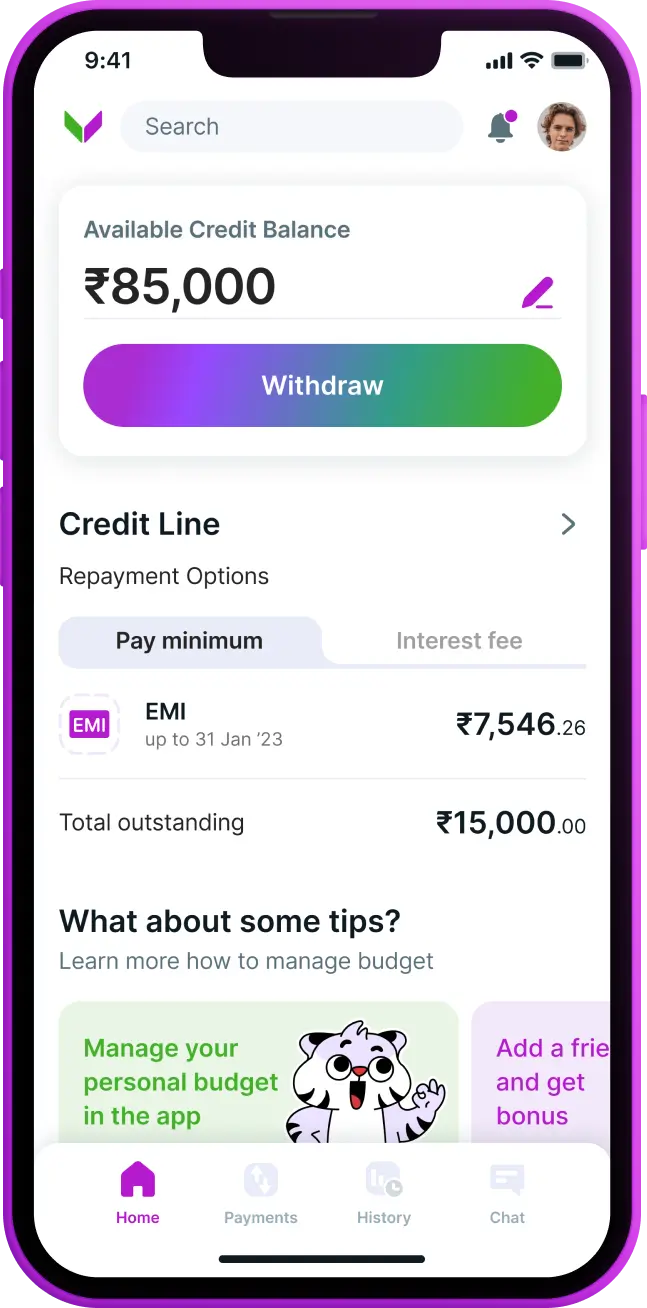

Benefits of using VIVA - Credit Line Loan

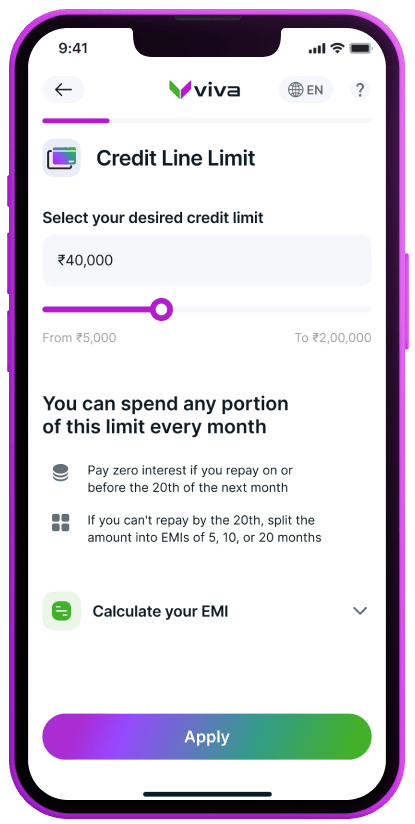

Credit limit:

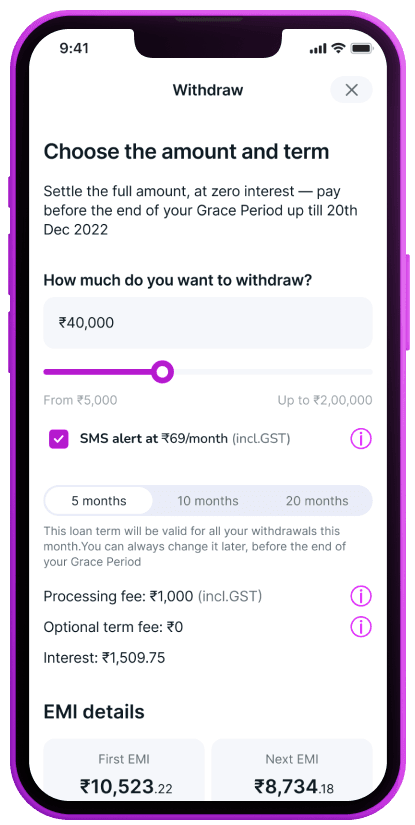

From ₹5,000 to ₹2,00,000Processing fee (One-time processing fee):

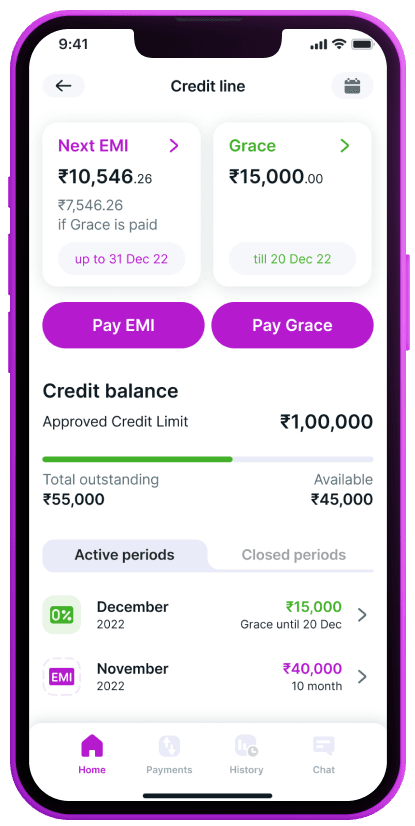

From ₹500 up to 3% of the approved credit limitGrace period:

Maximum 51 days if you withdraw on the 1st of the month (else, 20 days after the end of the withdrawal’s billing month)

How you repay

If Repaid within the Grace Period:

0% per annum interest charged

Otherwise, you can choose between 5, 10, and 20 month long EMI payments. In this case, the following conditions will apply:

Interest rate:

As low as 3-3.3% per EMIRepayment term:

– 5 months: No extra charge

– 10 months: ₹999

– 20 months: ₹1499Early repayment fee:

4% on the early repayment amount

Note: Minimum repayment amount is ₹10,000

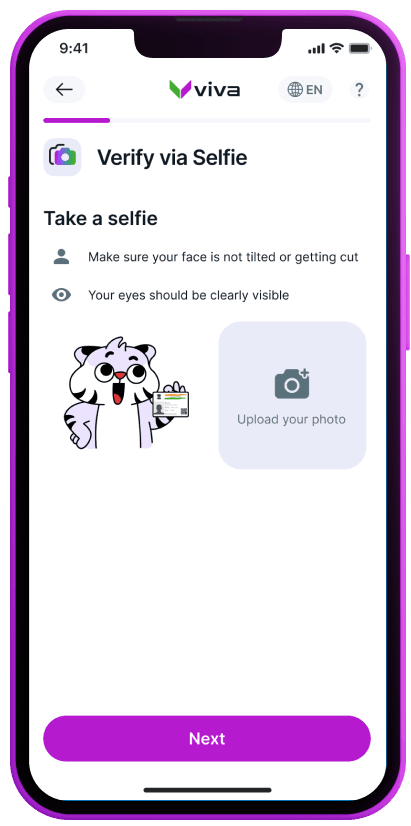

Minimal Documents Required

100% digital and completely secureIdentity Proof (PAN card)

Address Proof (Aadhaar number)

Photograph (Selfie)

Eligibility Criteria

You must be an Indian Citizen between 21 and 64 years of age

Your monthly income must be ₹15,000 or more.

Your monthly household income must be ₹25,000 or moreYou must be earning an official income either as a full-time, part-time, or self-employed professional

How we work?

Features You’ll Love

About us

Viva Money is a digital financial lending platform offering India’s 1st Line of Credit. By partnering up with Fincfriends Private Limited registered with RBI, VIVA provides an affordable & easy way of taking a revolving credit line.

Viva Money stands as a pioneering member within the Viva family, as it extends its presence to various countries including Mexico and Italy.

Learn more